Failing to do so means your lender will require you to pay back the loan.

Important Note: Be sure to maintain the property, pay real estate taxes, and homeowner’s insurance. You only need to repay the reverse mortgage when:

But of course, you eventually have to pay it back. You don’t need to make monthly mortgage payments. Think of it as a bank pre-paying you for your property before you actually move out. You can withdraw from the credit line as needed, and you don’t have to pay it immediately. With a reverse mortgage, borrowers get paid for their home without having to sell and move out of their property. But just like a regular mortgage, it uses your home as collateral. It allows you to withdraw a portion of your home equity and convert it into cash. The total amount is based on the equity of your home and your life expectancy. Instead, a reverse mortgage is the opposite of a traditional mortgage: It usually comes in a line of credit paid to you by a lender. While people might find it confusing, this is not at all a second mortgage which requires monthly payments. Taking a reverse mortgage is a popular financial strategy that helps generate more income during retirement. By knowing your loan options, we hope to help you make better financial decisions before and during retirement. We’ll also explain the benefits and disadvantages reverse mortgages. We’ll focus on Home Equity Conversion Mortgages (HECM), including qualifications for this type of loan and how they work. Our guide will discuss what reverse mortgages are and what they are used for. If you’re close to retirement, it’s a good time to look into reverse mortgages. Others may even want an extended vacation to enjoy their golden years. For some people, they might want extra money to purchase a better home more equipped for senior living. While you’ve saved enough for daily expenses, you also have to factor in extra medical bills and other important costs. But depending on your situation, you might need additional income to support you as you age.

Reverse mortgage calculator how to#

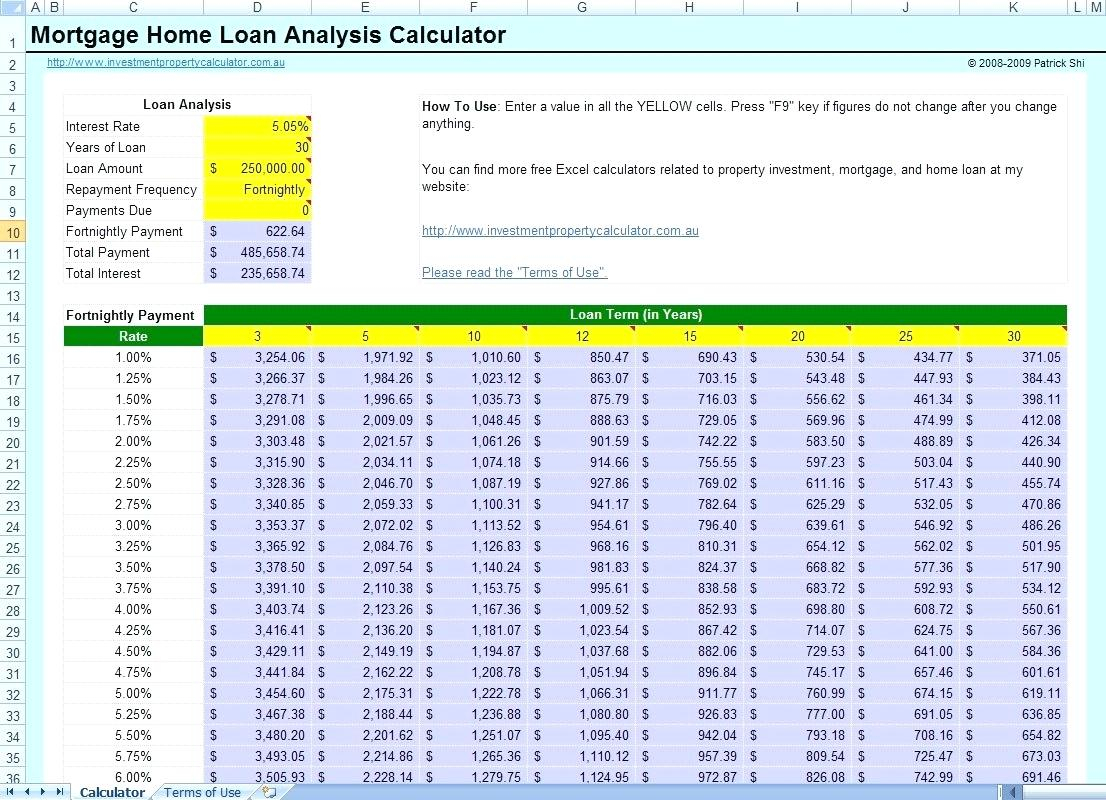

With our reverse mortgage calculator, just follow the instructions regarding your borrowing power, payment option, property and mortgage details and then view your results – you’ll see the way the property value, loan balance and remaining equity track together over time.Reverse Mortgages: What are HECMs and How to Use Them?īefore reaching your senior years, you’ve probably set aside savings and planned for retirement. This can be an attractive way for retirees to supplement their retirement income in situations where the equity in their home is substantial. The interest compounds over time and is added to your loan balance, you remain the owner of your house and can stay in it for as long as you want. As with any other loan, interest still applies but you don’t have to make repayments while you live in your home. A reverse mortgage allows you to borrow money using the equity in your home as security, and it can be taken as a lump sum, a regular income stream, a line of credit or a combination of these options.

Here we explore a different type of loan – the reverse mortgage. Home » resources » Finance Calculators » Reverse mortgage calculator Reverse mortgage calculator

0 kommentar(er)

0 kommentar(er)